Payroll tax estimator

Determine the right amount to deduct from each employees paycheck. Summarize deductions retirement savings required taxes and more.

Llc Tax Calculator Definitive Small Business Tax Estimator

Could be decreased due to state unemployment.

. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings. Subtract 12900 for Married otherwise. Unemployment insurance FUTA 6 of an employees first 7000 in wages 2022 2.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Most employers use this paycheck calculator to calculate an employees wages for the current payroll period. Medicare 145 of an employees annual salary 1.

Use your estimate to change your tax withholding amount on Form W-4. These calculators should not be relied upon for accuracy. To change your tax withholding amount.

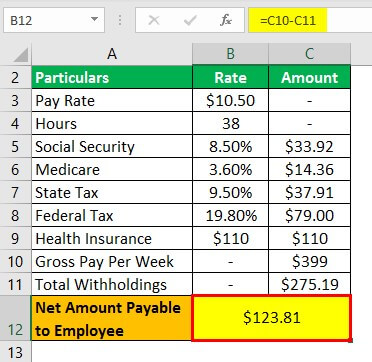

Get an accurate picture of the employees gross pay. If this describes your situation type in your employees gross. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks.

Or keep the same amount. Its never been easier to calculate how much you may get back or owe with our tax estimator tool. These calculators should not be relied upon for accuracy.

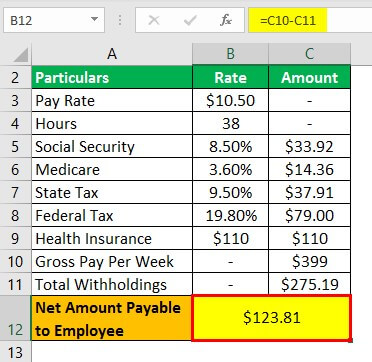

Payroll Taxes Taxes Rate Annual Max. It comprises the following components. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes.

Enter up to six different hourly rates to estimate after-tax wages for hourly employees. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Thats where our paycheck calculator comes in.

After You Use the Estimator. Plug in the amount of money youd like to take home. Computes federal and state tax.

The state tax year is also 12 months but it differs from state to state. Estimate your tax refund with HR Blocks free income tax calculator. The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and estimates.

The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and estimates. 2020 Federal income tax withholding calculation. The standard FUTA tax rate is 6 so your.

For any wages above 200000 there is an Additional Medicare Tax of 09 which brings the rate to 235. Employers have to pay a matching 145 of Medicare tax but. This component of the Payroll tax is withheld and forms a revenue source for the Federal.

Components of Payroll Tax. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Some states follow the federal tax.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

Payroll Formula Step By Step Calculation With Examples

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Payroll Tax What It Is How To Calculate It Bench Accounting

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

How To Calculate Federal Income Tax

Excel Formula Income Tax Bracket Calculation Exceljet

Payroll Tax Calculator For Employers Gusto

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate 2019 Federal Income Withhold Manually

How To Calculate Payroll Taxes Methods Examples More

Payroll Calculator With Pay Stubs For Excel

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Paycheck Calculator Take Home Pay Calculator

Calculation Of Federal Employment Taxes Payroll Services

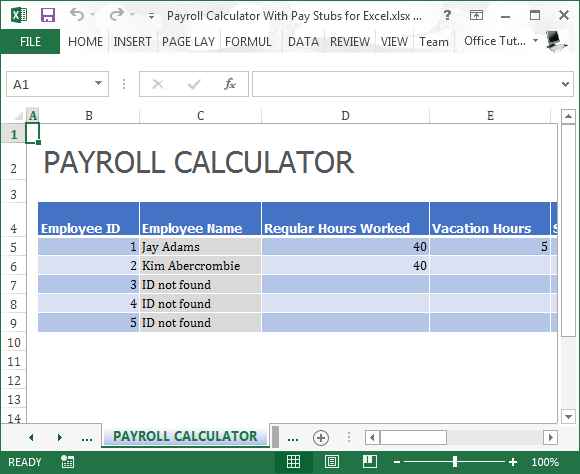

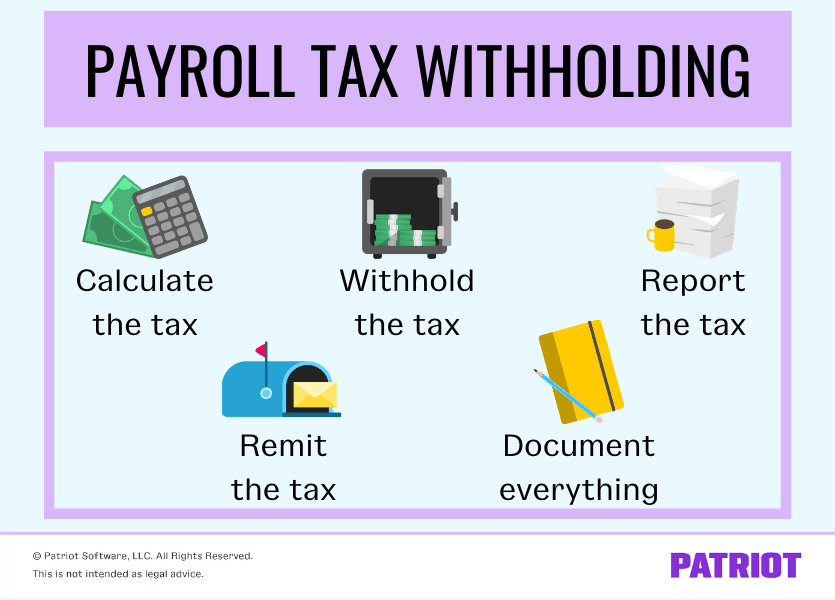

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding

Paycheck Calculator Take Home Pay Calculator